- The Diligent Observer

- Posts

- Nuclear's Factory Future, AI-powered Housekeeping, and 20,000 Creators Find Their Digital Home

Nuclear's Factory Future, AI-powered Housekeeping, and 20,000 Creators Find Their Digital Home

Happy Thursday.

Here are your angel deals of the week, some bookmarks I think you'll enjoy, and the best nugget from my interview with Tighe Smith.

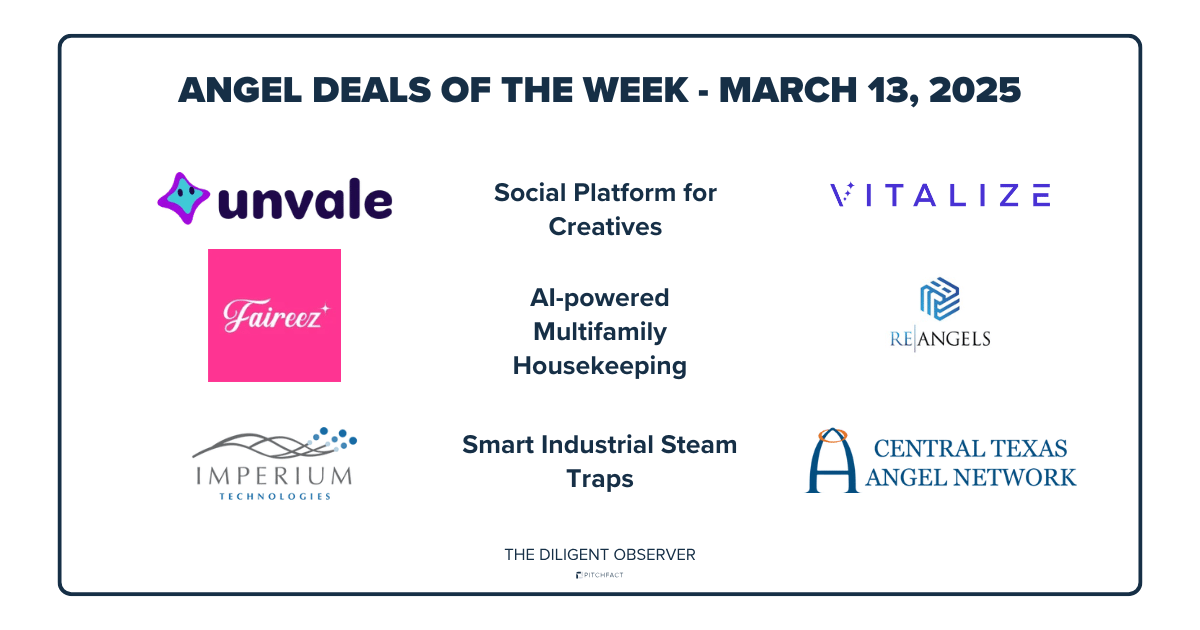

🔥Angel Deals of the Week

Angel funding rounds announced in recent weeks, compiled from public sources. Note: I have not personally vetted these companies and am sharing for informational purposes only.

🤝 Want more details on these companies or have an angel deal to share? Reply to this email - I’d be happy to connect you with the source community or feature your deal.

🔍Why These Deals are Interesting: Angel communities filter through hundreds, sometimes thousands, of opportunities each year. These companies represent the elite few that survived that vetting process and actually got a deal done.

Participating Group: Vitalize Angels

Unvale is a creator platform where illustrators, writers, and storytellers can share work, build audiences, and self-publish long-form content, currently serving 20,000 monthly active users who publish 160,000 original creations monthly with over 1 million social engagements. The company recently secured $1.8M in pre-seed funding from several investors including Antler, Graham & Walker, Ganas Ventures, and Vitalize Angels. According to the announcement, funds will be directed toward growing their userbase and implementing new content types and social features as they position themselves in the user-generated content market projected to reach $650 billion by 2030.

CEO & Cofounder Casey Lawlor | $1.8M Pre-Seed | Chicago, IL | March 11, 2025 | (Source)

Faireez | AI-powered Multifamily Housekeeping

Participating Group: RE Angels

Faireez is developing AI-powered hotel-style housekeeping services for multifamily buildings, currently partnering with top property management companies across four states. The startup offers a subscription model with dedicated housekeepers and task-based booking through its app, while incorporating AI for auto-scanning homes, quality assurance, and dynamic pricing. Faireez recently secured $7.5 million in seed funding led by Aristagora VC with participation from RE Angels, with plans to expand its technology and reach one million multifamily units by 2030.

Imperium Technologies | Smart Industrial Steam Traps

Participating Group: Central Texas Angel Network (CTAN)

Imperium Technologies is developing smart monitoring systems for industrial steam facilities to reduce energy waste, greenhouse gas emissions, and heating costs. Their technology addresses a critical issue where steam energy is lost through undetected trap failures. The company recently secured over $1.2 million in funding led by Central Texas Angel Network and Springbok Ventures. Early production units are selling at 2.5 times cost, with the company having completed successful trials, secured a patent, and received SBIR/NSF grants. Funds will be used to scale production, expand the team, and develop strategic partnerships.

CEO & Co-Founder Brad Medford | $1.2M Seed Round | Austin, TX | February 6, 2025 | (Source)

🔖Bookmarks of the Week

🥇The Nugget: My Top Takeaway from This Week’s Interview with Tighe Smith

Nuclear construction is evolving from “one-off” bespoke plants to more standardized designs.

Tighe compared the process to how an aircraft manufacturer builds a factory with high upfront costs, followed by materially lower marginal cost per each new plane.

"Nuclear reactors, although they require safety systems... are not terribly complex devices" - they've just lacked standardization.

The old plants "were all built bespoke" with no common control systems or mechanical systems. That's (part of) why they have historically been so expensive and slow to build.

But according to Tighe, companies like NuScale, X Energy, and Westinghouse are designing newer models with "commonality of parts" and factory production in mind.

Some questions for Angels to ask when evaluating a nuclear deal:

Does the concept rely on mature fuel technology that exists today at scale?

Does the technology rely on “standardized designs” that don't require new material science breakthroughs?

Is there a plausible customer with the balance sheet ($1B+ in Tighe’s estimation) to build?

We can put in a natural gas plant in <2 years thanks to factory-built turbines. Nuclear is moving toward the same model.

Want more? Check out my full conversation with Tighe 👇

🎙️ Latest Podcast Episode

Listen now on Spotify, Apple Podcasts, and YouTube.

Until Next Week👋

Thanks for reading - have a great week.

-Andrew

P.S. If you enjoyed this post, could you do me a quick favor? Hit the "like" button or leave a comment with your thoughts. It may not seem like much, but it really helps me out a ton.

⚛️A Note on Nuclear

I've spent the last few months deep diving into the early-stage nuclear energy investing landscape. After analyzing piles of Pitchbook data, interviewing industry experts, and reading way too much, I’ve pulled out the essential information to build the guide I wish existed when I started researching this space.

The Nuclear Energy Investing Playbook drops in March 2025. It includes analysis of 80+ startups, proprietary market research, and a framework to help angels navigate this complex but opportunity-rich sector.

Interested? Pre-order now for $79 (regular price $99). Want it for free? Subscribe and refer one friend to the newsletter (be sure to click the button to get a referral link) by March 15, 2025.

If you’re finding this newsletter valuable, share it with a friend, and consider subscribing if you haven’t already. You can also find me on LinkedIn and X.

How did I do this week?

About Me

I cultivate flourishing.

I'm a proud husband, grateful father, and honest friend. My love languages include brisket, bourbon, and a handwritten note.